What nonprofit organization doesn’t dream of getting a major donation out of the blue, or hope that one day a wealthy philanthropist will hear of their good work and write them a big check? SAFE is a growing horse rescue with a pretty long wish list, filled with things that could make it easier to fulfill their mission to help neglected equines. A bigger horse trailer…a new paid employee to work at the barn…maybe even a farm of our own. As long as dreams are free, it doesn’t hurt to say a little prayer once in a while that a big donation will land in our lap someday.

But there’s also that old adage: if it seems too good to be true, it probably is.

SAFE’s Executive Director Bonnie Hammond has been leading the organization’s fundraising efforts for the past ten years. Along the way, she’s learned not to count on gifts until they are in hand. So when she received an email on December 30, 2015 from a gentleman interested in making a donation to her non profit, Hammond kept her excitement in check. “He claimed to be an architect from London who wanted to make a donation in memory of his mother, who had recently passed away,” Hammond said. “His first message to me was an inquiry as to who he should speak to about making a contribution.”

Hammond invited him to call her, but the phone never rang. Instead she received a second email saying that the architect wished to donate $30,000 in his late mother’s name. At this point, Hammond went to the internet where she discovered that there was indeed a real person with the name she’d be given, who did own the architectural firm in London where the gentleman claimed to be writing from.

“He asked me how we might use the gift, and I responded with some suggestions as to how we might create a fitting legacy for his mother. Again, I asked him to call me so we could talk more. He’d given no information as to how he had chosen my horse rescue to donate to. In fact, he never mentioned horses at all. So something seemed off about the whole thing.”

The gentleman said he would let Hammond know when the check had been sent. “At that point, I was fairly certain I would never hear from him again. A $30,000 gift would have had a significant impact on the rescue, and it was impossible not to dream about what we could use that money for. At the same time, it just seemed too good to be true.”

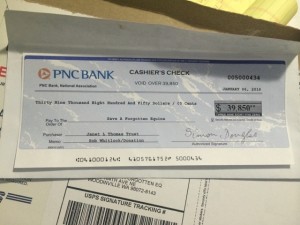

On January 7, the architect sent another email, saying that the funds had been cleared and a check was on the way. Later that same day, the postman knocked on the door with a Priority Mail envelope that needed to be signed for. Inside the envelope was a cashier’s check in the amount of $39,850.

“It looked so real,” Hammond remembers. “It was drawn from an account at a real financial institution, it had all the security features that you see on a real check, it was even signed in ink. We were absolutely floored. It really looked like we had just gotten the largest donation we had ever received.”It did not take long for the other shoe to drop. The next morning, Hammond received an email from the architect, saying that his accountant had made an error. He was supposed to have sent $30,000 to SAFE and the extra $9,850 had been intended for a young girl suffering from diabetes who needed to undergo surgery immediately. His accountant had accidentally sent the entire amount to SAFE. He asked for my help in getting the extra funds back as quickly as possible.

“At this point, I recognized the scam,” Hammond says. “Had we deposited his check in the bank and returned the extra money to him as requested, we would have discovered a few days later that the check was no good, and we would be out $9,850 of our own money.”

Fortunately, Hammond had not attempted to deposit the check. A phone call to the fraud department of the bank it was drawn on revealed that the bank account on the check was real, but that a check hold had been placed on it. Hammond has since reported the attempted fraud to the FTC and the state’s Attorney General’s office. She also sent a message to the actual person in London that the scammer was impersonating, but has not been contacted back.

“This was a very carefully planned scheme. Up until the point where I was asked to send back money, it appeared genuine. The scammers went to a great deal of trouble, registering a domain name, sending the check via registered mail, and using a real cashier’s check. It was all pretty convincing.

SAFE wants other nonprofits to know that there are people out there who may attempt to prey on their good work. “It’s very easy to get caught up in the excitement of receiving a large donation,” Hammond admits, “but you have to be cautious. If it seems too good to be true, it probably is.”

Dreams of a bigger horse trailer and the other wishes on SAFE’s wish list will have to wait. Right now it is important that other non-profit organizations get the word that there are people out there who would gladly scam charities of out funds they can’t afford to lose. Please spread the word!